- …

- …

Accounting, Tax and Administrative

Internal Audit

Statutory Audit

Agreed Upon Procedures

AFC Policies & Internal Control Design

Accounting, Tax and Administrative

Internal Audit

Our Internal Audit Service advisory provides support to the accounting and administrative function of an enterprise in monitoring accounting and tax compliance, managing effective internal accounting controls, evaluating risks and providing insights and analysis to support business decisions.

Corefin performs standard and tailored substantive procedures with typical audit approach with results and findings elaborated for internal perusal only. Our reporting feedbacks shall provide investors with an insight on the status of the financials and compliance through an independent eye and support in the elaboration of raw financial information.

1Administrative

Compliance

Perform verification of the administrative compliance in terms of periodic procedures (annual inspections and special reports), certificates, licenses and authorizations (including renewals) to ensure their conformity with PRC law & regulations and allow an enterprise to conduct its operations appropriately

2Financial

Audit

Perform financial statement review to ascertain conformity with the application of the Chinese Accounting Standards (CAS) principles at sub-account level through verification of existence, correctness, validity, valuation and cut-off for higher-value transactions on a sample basis:

3Tax

Audit

Verification of fulfillment of tax obligations: Enterprise Income Tax, VAT, Individual Income Tax, Employees Social Contributions, Stamp Duty Tax, Surcharges and other applicable taxes. Ascertain compliance with monthly & annual fiscal requirements and returns.

4Internal

Controls

Highlight any internal accounting control deficiencies noted during the financial statement review. Advise on implementation of internal control robustness.

5Management Reporting

Feedback

Drafting of a customized internal management Reporting Package according to CAS / IFRS / ITA Gaap or other customizations,. Develop key performance metrics (KPI Indicators) and provide analysis of business performance.

6AOR

Drafting of a detailed Accounting Overview Report which includes an analysis of the main items of the balance sheet and the profit and loss; provides relevant numerical sub-details to facilitate a greater understanding of the accounting principles and standards applied, lists the internal audit activities we have carried out; any issues identified, and suggested solutions.

7Management Letter

Drafting of Management Letters/Executive Summary aimed at recalling observation and recommendations from our technical experts to those in charge with management or governance and verify time by time what is the status of reception of our suggestions; ML will outline any Performance Improvement Opportunities (PIO) listed by importance level (High, Moderate and Low) and Subject matter.

Statutory Audit

The compulsory year-end milestone.

PRC Statutory Audit of Local Financial Statement

Our Local Compliance Role

Statutory Audit performed by a «Certified Public Accountant Firm» duly registered and authorized in People’s Republic of China (PRC) in compliance with local Auditing Standards with the Issuance of an Annual Report including an Audit Opinion on the Financial Statements drafted in accordance PRC GAAP.

We collaborate with the local CPA Firm in order to develop a common audit plan, sharing our methodology and team and facilitate the sharing of Group Referral Audit Instructions from the headquarters component entity to its Chinese subsidiary.

Audit of Reporting Packages for Group Consolidation Purposes

Our Group Compliance and Reporting Role

Audit of the Reporting Package drafted according to the Group GAAP, as instructed by your Group Auditor in compliance with International Auditing Standards with the Issuance of an Audit Report including our Opinion about whether the Rep. Package was prepared in conformity with the instructions issued by Group management for consolidation.

Our Audit Opinion is jointly signed by PRC CPA Firm and Italian Chartered Auditor registered at the bar held by the Italian Ministry of Economy and Finance.

Agreed Upon Procedures

A narrower, limited-in-scope audit focusing on specific areas of the financial statements

AUP

AUP are suggested to preliminary evaluate the behavior of company management in accordance with internal policies or targeting specific financial accounts; to be conducted under the signature of a chartered auditor in accordance with International Standard on Related Services (ISRS 4400) with the purpose to carry out specific audit procedures which auditor and the Company have agreed on and to report on factual findings.

AFC Policies & Internal Control Design

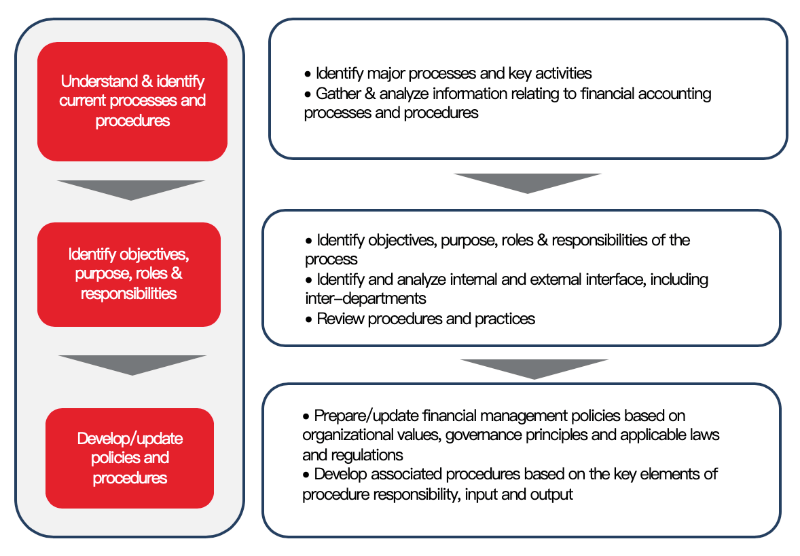

AFC (Accounting, Finance & Control) policies enable process owners to understand what the organization intends to accomplish and procedures delineate the steps required or the activities to be performed to accomplish a specific task. We can help enterprises to prepare, update and customize the standard operating procedures to formalize the processes in place, create consistency and set accountability for the execution of business activities and processing of business transactions.

Our approach to developing standard operating procedures is focused on ensuring that organization values, principles and compliance with the applicable laws and regulations are adhered to and that roles and responsibilities are clearly outlined with input and output of the process/activity/task clearly defined as depicted above.

Stay tuned!

Do you need highlights in understanding what's going on in China?

Remain informed about the latest articles, releases and publications.

Enter in your information below to subscribe to our Newsletter.

We need the contact information you provide to us to share with you informative material. You may unsubscribe from these communications at anytime. For information on how to unsubscribe, as well as our privacy practices and commitment to protecting your privacy, check out our Privacy Policy.