- …

- …

Investor / Vendor Due Diligence

Forensic Due Diligence and Fraud Detection

Governance, Risk & Control

Remote CFO / Controller

Staff Loan

Investor / Vendor Due Diligence

Corefin provides tax and financial due diligence services to acquirers or investors to assist in assessing the target business or vendors in assessing their operations up for sale. Our due diligence aims to minimize risk by maximizing investor/vendors financial information accuracy to facilitate their decision. We add value to the deal by providing detailed analysis of the target’s financial data and develop a report and Management Letter focusing on significant issues, findings and recommendations. We also provide post acquisition support to achieve the integration benefits, synergies and operational efficiencies.

1Co-Develop

Expectations

- Develop an understanding of acquirer’s financial due diligence focus

- Obtain target company information and validate requirements

- Pre-assessment of data availability to cover the agreed areas.

2Analysis of Target's Information

- Perform analysis of target’s key performance data/business drivers (e.g. earning related data, net assets & funding items, working capital analysis etc) and corporate compliance status

- Perform of Substantive Analytical Procedures (SAP) with universal external audit approach on significant financial items, paying particular attention to the risk of overstatement of assets and understatement of liabilities or tax contingencies

- Identify deal related issues.

3Discuss, Communicate and Report Findings

- Summarize findings and discuss with client key risks and issues identified

- Complete report to be delivered to client.

4Post Acquisition Support

- Provide post acquisition assistance in the areas of accounting compliance, reporting and management,

- Support in the due diligence implementation of recommendations and fixing of findings

- Process integration and corporate compliance and monitoring activities.

Forensic Due Diligence and Fraud Detection

Specific fraud investigations techniques and methodology can be applied in specific case on client request with the objective to identify non-compliance due to fraud or error, and to limit investors or company's responsibility.

Forensic Due Diligence

The work of the forensic accountant on due diligence matters generates information that allows the buyer (and the seller) to make more informed decisions, ensuring transparency and thereby limiting potential pitfalls and conflicts.

- In addition to conducting investigative due diligence on principals and their associates' acts on the Company, Corefin’s financial investigations professionals can undertake forensic due diligence on an organization, providing a review of financial transactions, accounting, compliance and operations by identifying and assessing questionable transactions and risk areas as the first line of defense in preventing and detecting fraud, financial crimes or potential sanctions-related issues.

- The fallout from discovering internal control failures after acquisition may have tremendous regulatory implications, including exposure to fraud, corruption and damages levied as a result of compliance violations.

- Usually these engagements are carried out jointly with a law firm.

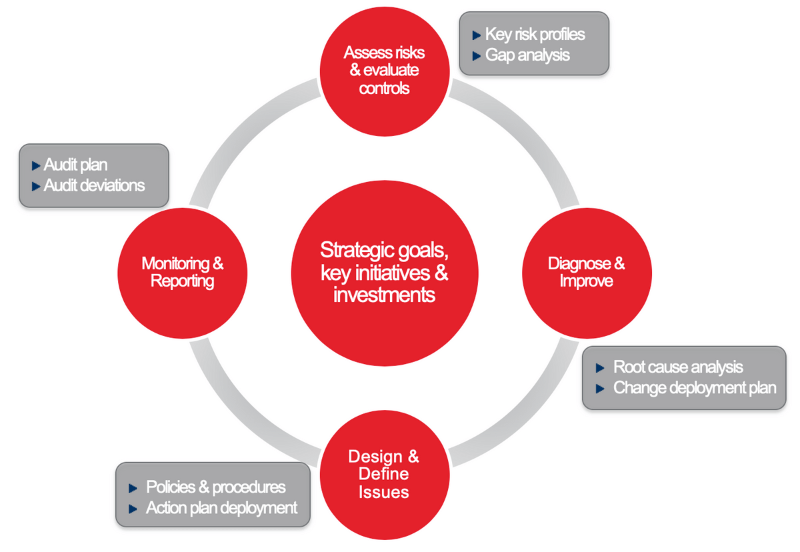

Governance, Risk & Control

Corefin recognizes that taking risks can create incredible business opportunities for a wide range of companies. The only feasible way this can happen is when the internal structure of a company, with due understanding of key business risks, is properly managed. We assist companies, undergoing company expansion, increased regulatory scrutiny and consequent organizational reforms, in enhancing their corporate governance and structure, improve and optimize administrative processes and internal controls in order to increase efficiencies and in turn generate greater returns for their shareholders. Enterprises faced by unavoidable change must strive to define a corporate governance, internal control framework, functional policies and procedures that are appropriate relative to their industry and phase as they transition to the next phase of development in their organizations. The approach shall develop across the four main organizational areas of Corporate Governance Structure, Processes, Performance Monitoring & Reporting and Accountability.

1Corporate Governance Structure

- Assessing the governance framework and organization through performance monitoring and accountability

- Evaluating financial risks of the business environment to confirm or modify the effectiveness of operational strategies

- Identify potential impact of identified risks, any duplication of employee effort, lack of due duties segregation, and potential gaps in risk coverage.

2Processes

- Perform internal audit to identify organization/entity-level control environment and/or transaction-level key business risks

- Identify and evaluate effectiveness of entity and/or transaction-level controls to mitigate key business risks

- Develop recommendations for improvement and, if required, the design and implementation of internal control monitoring program.

3Performance

Monitoring & Reporting

Assist in evaluating internal controls across the organization relative to operational, compliance and/or financial risks to confirm control design effectiveness or compare current state to leading practices (i.e. gap analysis).

4Accountability

- Assist organization to diagnose and define issues

- Assist in change deployment planning to remediate process and/or control deficiencies and to help achieve the desired future state.

5Risk

- Assist organization in managing contract risks with business partners

- Assist in performing agreed upon procedures related to attributes of contract, related processes and controls and

- Develop tools to ensure adherence by the counterpart to the contractual terms.

Our practical approach to Governance, Risk and Control is to co-develop with you a customized approach, tailored to focus on key areas of your business and the specific issues to be addressed, aligned with your strategies, objectives and major business initiatives. This allows us to efficiently design an assessment, testing strategy and develop recommendations for improvement plans that are focused on your key risks.

Remote CFO / Controller

Our experienced professionals have proven track records in financial management specifically in Chinese business settings. They bring you insights on local best practice to save money, mitigate business risks and maximize your profit, as well as expertise that make your business more measurable, stable, profitable and predictable.

By acting as your external CFO/Controller, our professional advisor shall:

A small tagline

- Oversee your accounting function and assist in / review the preparation of management reporting

- Propose tax planning & optimization

- Direct and monitors your internal administrator to carry out the accounting and reporting activities

- Look after your financials for detecting costing inefficiencies and proposing cost saving scenarios

- Provide business data modeling, create data collection mechanism and design KPI and management reporting system.

- Run business risk evaluation and health analysis

- Analyze financial results, KPIs as a driver of the organizations performance

- Find innovative and practical performance improvement or profit enhancing solutions, covering operational functions, technology and systems, as well as human resource.

- Prepare cash flow forecasting and monitoring

- Controls budget preparation and actual vs. budget assessment

- Attend periodical meetings with the company management to review, interpret financial results and answer questions.

Strategic financial and management advice designed to meet your growth objectives

Staff Loan

We can dispatch our staff to you for covering temporary vacancies in your AFC department

Unexpected last-minute vacancies?

Borrow our professionals as long as you need.

Our local professional consultants shall be at your premises ad-interim for covering temporary vacancies in different areas and tasks within the Administration, Finance and Control functions (Finance Controller, Finance Manager, GL specialist, AR/AP accountant, cash accountant, etc).

Stay tuned!

Do you need highlights in understanding what's going on in China?

Remain informed about the latest articles, releases and publications.

Enter in your information below to subscribe to our Newsletter.

We need the contact information you provide to us to share with you informative material. You may unsubscribe from these communications at anytime. For information on how to unsubscribe, as well as our privacy practices and commitment to protecting your privacy, check out our Privacy Policy.